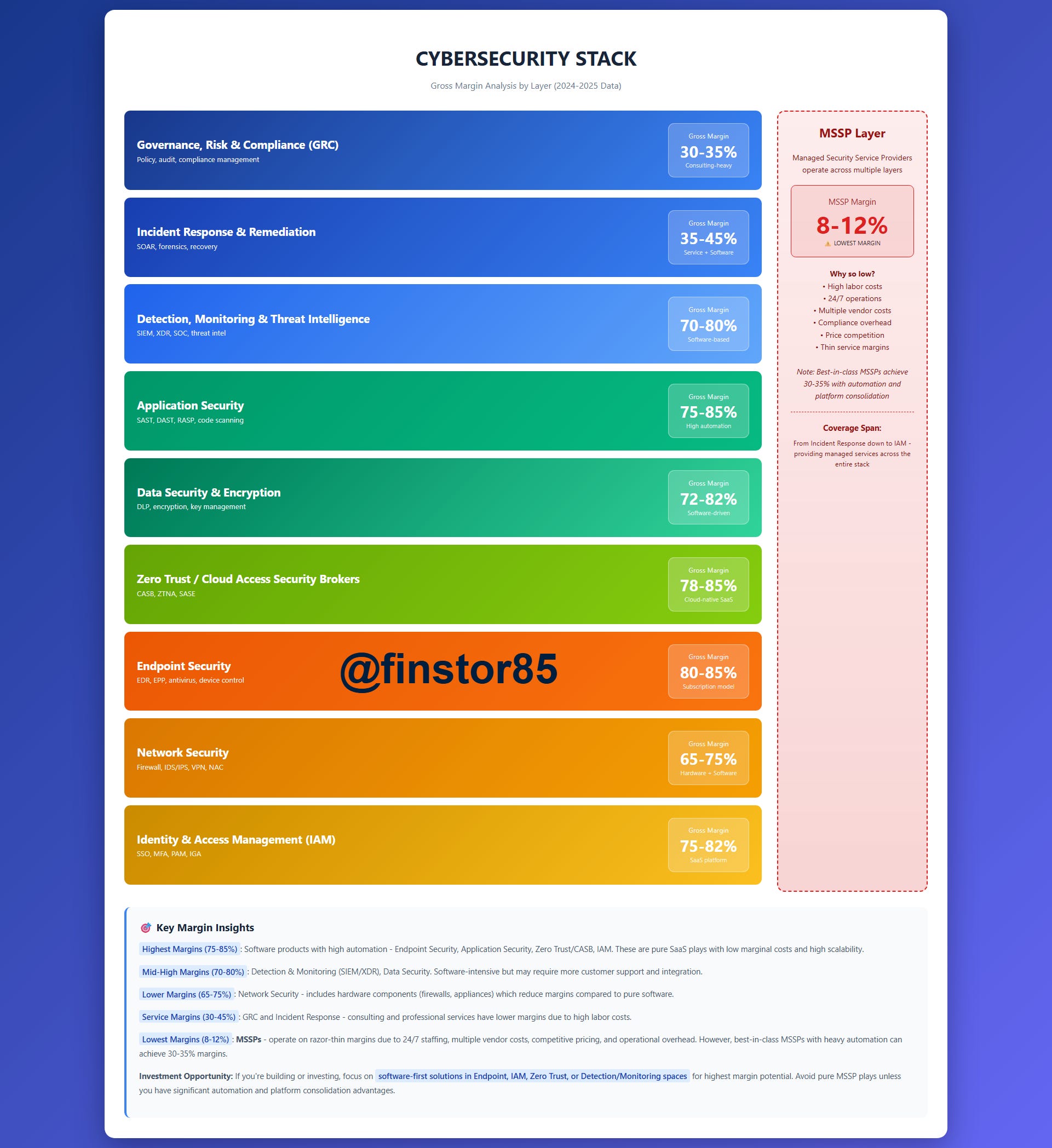

Cybersecurity Stack: Gross Margin Analysis by Layer

What investors miss about cybersecurity: margin structure, value pools, and where returns concentrate.

Cybersecurity is undergoing a structural shift: attacks are becoming more automated, but so is defense. This transition is reshaping the margin profile across the stack.

Governance is still consulting-heavy.

Incident response is part services, part tooling.

Threat intel and app-sec are increasingly software-driven.

MSSPs remain stuck in low-margin operations unless they automate aggressively.

This post walks through the economics of each layer and what it means for evaluating cyber companies in 2024–25.

Ameya Bhai - I understand you don't invest in US listed companies but from study perspective - take a look at RBRK - Leading Cybersecurity Data Recovery and Back-up business. It is trading at cheap valuations against it peers but what a multi product company in making.

Quickheal (End point), 3i Infotech and TacInfo Sec seems listed companies which are pure play in cybersecurity